Finspect Tax Consultancy

“Our mission is to simplify tax and accounting for businesses that are just getting started — because that’s when the right advice matters the most.”

— Dilna Suresh, Founder & FTA-Approved Tax Agent

Serving the UAE with integrity - FTA Approved Tax Agency

Hi, I’m Dilna Suresh.,

Founder of Finspect Tax Consultancy and an FTA-Approved Tax Agent (TAAN. No. 20058764/30013916) officially listed in the UAE Government’s Federal Tax Authority’s directory of approved tax agents

When I started Finspect, my purpose was simple: help entrepreneurs like you get affordable, reliable, and expert-led accounting services without the overhead of hiring in-house staff and also without breaking the bank.

As a business owner myself, I understand the challenges that entrepreneurs face — especially when it comes to staying compliant with tax laws, managing books, and avoiding costly mistakes.

At Finspect Tax Consultancy, we are doing exactly that!!!

We make professional accounting and tax consultancy accessible and affordable for mainly start ups and small businesses.

ABOUT US

Practical Financial Advice You Can Count on

Finspect Tax Consultancy is a client-focused professional firm backed by qualified and experienced Chartered and Management Accountants.

Our goal is to be a comprehensive solutions provider, helping clients tackle the complexities of modern business through personalized service and strategic outsourcing.

We specialize in the following –

Our Leadership Team

K.S. Binoj

- Associate Member of The Institute of Chartered Accountants of India (ACA), Certified Management Accountant (UK, ACMA), and

Certified Global Management Accountant (CGMA). - With over 20 years of international experience across multinationals like Aeon Hewitt, Outsource Partners International, Accenture Financial Solutions , Thyssen Krupp and Media Pro International.,

Binoj has served as Group Financial Controller / CFO for prominent Middle East businesses and various other local groups as well.

Dilna Suresh

- With over 7 years of experience in Audit & Taxation, Dilna Suresh brings a deep understanding of local UAE laws and financial regulations. She has worked with leading firms including Varma and Varma Chartered Accountants (India) and Baker Tilly MKM (Abu Dhabi, U.A.E.), where she has served a wide range of clients across various industries.

- Now an FTA-Accredited Tax Agent, Dilna combines her technical expertise with a client-first approach, ensuring compliant, strategic, and practical solutions for businesses in the UAE.

Founder | FTA-Approved Tax agent

Why Choose us

Trusted, Transparent, and Tailored Financial Solutions

Instead of hiring a full-time accountant (who may or may not have expertise in UAE tax law), you can now outsource your entire accounting and tax function to a trusted FTA-Approved Tax Agent — at a fraction of the cost. Moreover the FTA accreditation confirms our compliance with the highest standards of technical knowledge, ethics, and regulatory practice required by the UAE government.

Integrity & Confidentiality

We handle your data with care and uphold strict confidentiality in all transactions.

Personalized Client Service

Quick responses, customized solutions, and hands-on support you can count on.

Experienced Professionals

Led by qualified experts with global exposure in finance, audit, and advisory.

Why Startups Choose Us

In-House Accountant

- AED 8,000 – 12,000/month

- May lack UAE tax knowledge

- Needs training & oversight

- Fixed overhead cost

Finspect Tax Consultancy

- Starting at AED 1,000/ - 1,200/month

- Led by FTA-Approved Tax Agent

- Fully managed service

- Flexible & scalable pricing - No End of Service Benefits etc

Services

Comprehensive Financial Solutions

Finspect Tax Consultancy is a professional firm of Chartered and Management Accountants based in Dubai, UAE. We specialize in Accounting, Auditing, Tax consulting, AML services, Payroll services and CFO services, offering seamless solutions for modern businesses.

ACCOUNTING

Accurate accounting helps startups understand where money is coming from, where it’s going, and how much runway remains. This clarity allows founders to make confident, informed decisions.

- Online Accounting

- Closing Books of Accounts

- Financial Reporting

AUDITING

Audit services provide an independent evaluation of a company’s financial statements, enhancing transparency, accuracy, and trust among stakeholders. For businesses, audits help ensure compliance with regulatory standards and identify areas for financial and operational improvement.

- External Audit

- Internal Audit

TAX CONSULTING

Tax consultancy services are essential for ensuring compliance with complex tax regulations while identifying opportunities to legally reduce tax liabilities. For startups and growing businesses, expert tax advice can help avoid costly penalties.

- Corporate Tax Return Filing

- Corporate Tax Registration

- Vat Registration and De registration

AML SERVICES

AML services help businesses detect, prevent, and report suspicious financial activities to comply with regulatory requirements and combat financial crime. avoiding heavy penalties, and protecting against reputational risks.

- Customer Due Diligence

- Suspicious Transaction Reporting

- Identifying PEPs

Payroll Services

Payroll services ensure that employees are paid accurately, on time, and in full compliance with labor laws and tax regulations. By outsourcing payroll, businesses can save time, reduce errors, and focus on core operations while ensuring confidentiality and legal compliance.

- Maintenance of Payroll register

- Petty Cash Reimbursement claim Forms

- Accurate Employee Compensation

CFO SERVICES

CFO services provide strategic financial leadership, helping businesses make data-driven decisions, manage cash flow, and plan for sustainable growth. For startups and SMEs, outsourced CFO support ensures expert financial guidance without the cost of a full-time executive.

- Forecasting for investors

- Budgeting and cash flow planning

- Fund raising suppport

news and articles

Stay Updated with Our Insights

The Ministry of Finance (MoF) and the

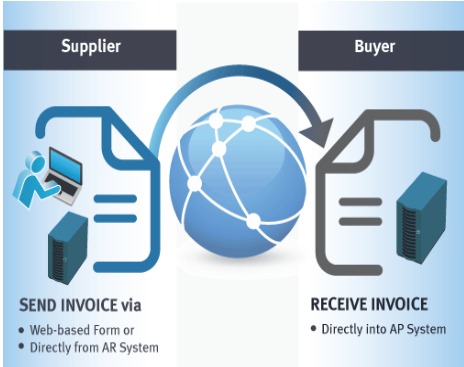

Electronic invoicing (e-Invoicing) is the exchange of